Unlocking the Secrets of a $20 Million Net Worth

Having a net worth of $20 million may sound like a dream reserved for the elite, but with enough time and discipline, this milestone is more achievable than ever. Inflation and investment returns are making it easier to reach this level of wealth, especially if you start early.

Imagine retiring with a $3 million net worth invested in risk assets. With a compound annual growth rate of 10%, you could reach $20 million in just 20 years. Even with a more conservative 6.5% growth rate, you could still hit that mark in 30 years. It’s all about patience and smart investing.

A Glimpse Into the Lives of $20+ Millionaires

Let’s take a closer look at some profiles of individuals with a $20+ million net worth to gain insight into how they achieved their wealth and what their plans are for the future.

Multimillionaire Profile #1: The Estate Tax Strategists

A couple in their late 50s and early 50s with two kids have amassed a net worth of $19–$21 million, primarily through real estate investments and stock holdings. Their goal is to reach a target net worth of $27.22 million to maximize estate tax exemptions.

Despite their wealth, they continue working to take advantage of increasing thresholds and to maintain a comfortable lifestyle. Wealth accumulation has become like a game to them, motivating them to stay in the game.

Multimillionaire Profile #2: The Money-Making Duo

This couple in their 40s has a net worth of $25–30 million, mainly driven by their successful online education business. They enjoy a lavish lifestyle in New York City, indulging in luxury living and exotic vacations.

With no children, they revel in their financial freedom and are focused on growing their wealth even further. Their story is a testament to the power of entrepreneurship and finding novel ways to make money.

Multimillionaire Profile #3: The Corporate Power Couple

Two high-earning executives in their late 40s and early 50s have a combined net worth of $20 million, primarily from their lucrative careers in tech and finance. Their smart financial decisions and long-term planning have set them up for a comfortable retirement.

While one partner enjoys the flexibility of working from home, the other is eager to retire early. Their story showcases the importance of strategic career choices and financial planning for long-term success.

Multimillionaire Profile #4: The Startup Success Story

A couple in their 30s with a young child struck gold twice with successful startup ventures, leading to a net worth of $20 million. However, most of their wealth is tied up in illiquid assets, posing a challenge for immediate spending.

Their story highlights the role of luck in wealth accumulation and the importance of diversification to ensure financial stability in the long run.

Multimillionaire Profile #5: The Early Retirees

After successful careers in finance and education, this couple in their 50s has retired early to focus on slow travel and homeschooling their three children. Their diversified investments and disciplined savings habits have set them up for a comfortable retirement lifestyle.

With a net worth of $23–$25 million, they prioritize family time and experiences over material wealth, showing that true happiness comes from living life on your terms.

Multimillionaire Profile #6: The Frugal Veterans

A seasoned couple in their 70s has amassed a net worth of $20 million through prudent real estate investments and government pensions. Despite their wealth, they prefer a modest lifestyle, focusing on family and charitable giving.

Their story is a testament to the enduring value of frugality and smart financial habits, passing down a legacy of financial responsibility to future generations.

Key Takeaways

- Building wealth as a couple can accelerate financial growth.

- Longevity in high-paying careers and diligent saving are key to achieving exceptional wealth over time.

- The composition of your net worth impacts your financial freedom and lifestyle choices.

- Luck plays a significant role in amassing substantial wealth through unique opportunities.

- Decumulation, or spending down wealth, can be challenging for those accustomed to saving and investing.

- Passing down good financial habits to children is essential for maintaining generational wealth.

- Successful wealth accumulation often involves a mix of lucrative careers, real estate investments, and entrepreneurial pursuits.

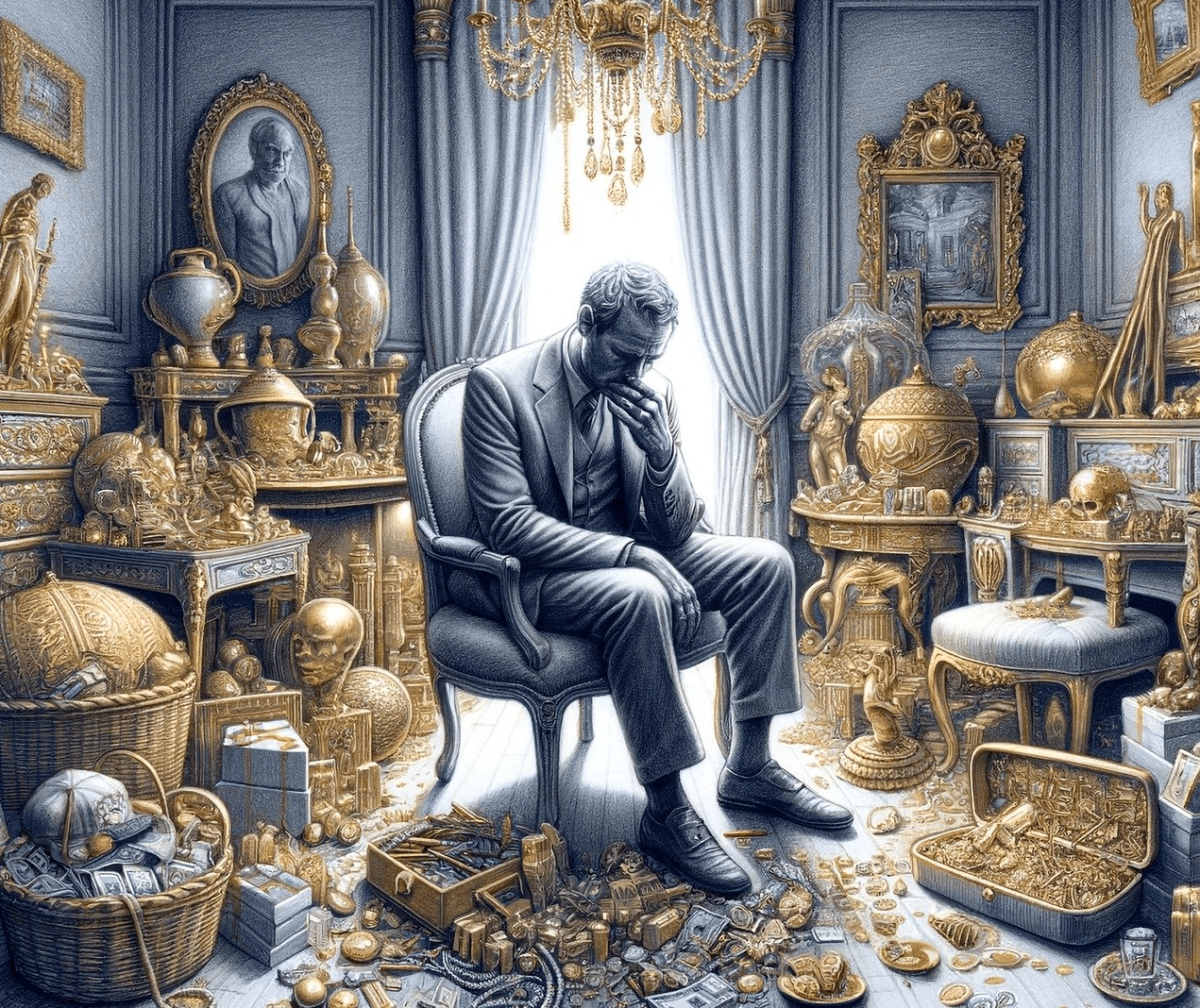

- Excess wealth does not always equate to greater happiness, highlighting the importance of finding the right balance between financial security and personal fulfillment.

Get a Financial Checkup

If you have over $250,000 in investable assets and would like a free financial checkup, schedule an appointment with an Empower financial advisor. Ensuring your financial strategy aligns with your goals and risk tolerance is crucial, especially during times of economic uncertainty.

Remember, financial independence is within reach with the right strategy and guidance. Subscribe to the Financial Samurai newsletter for more insights and tips on building wealth and achieving your financial goals.