Defending Investor Rights: The Case for Climate Risk Management

Risk management is a fundamental aspect of financial analysis, yet as we navigate the challenges of climate change and sustainability, the ability of investors to assess and address risks is being hindered. Laws and regulations are being proposed and enacted that restrict investors from considering the financial impacts of climate change, despite the clear evidence of its effects.

It is crucial to defend the freedom of investors to act responsibly and uphold the principle of risk management. The importance of this cannot be overstated, especially in the face of the climate crisis.

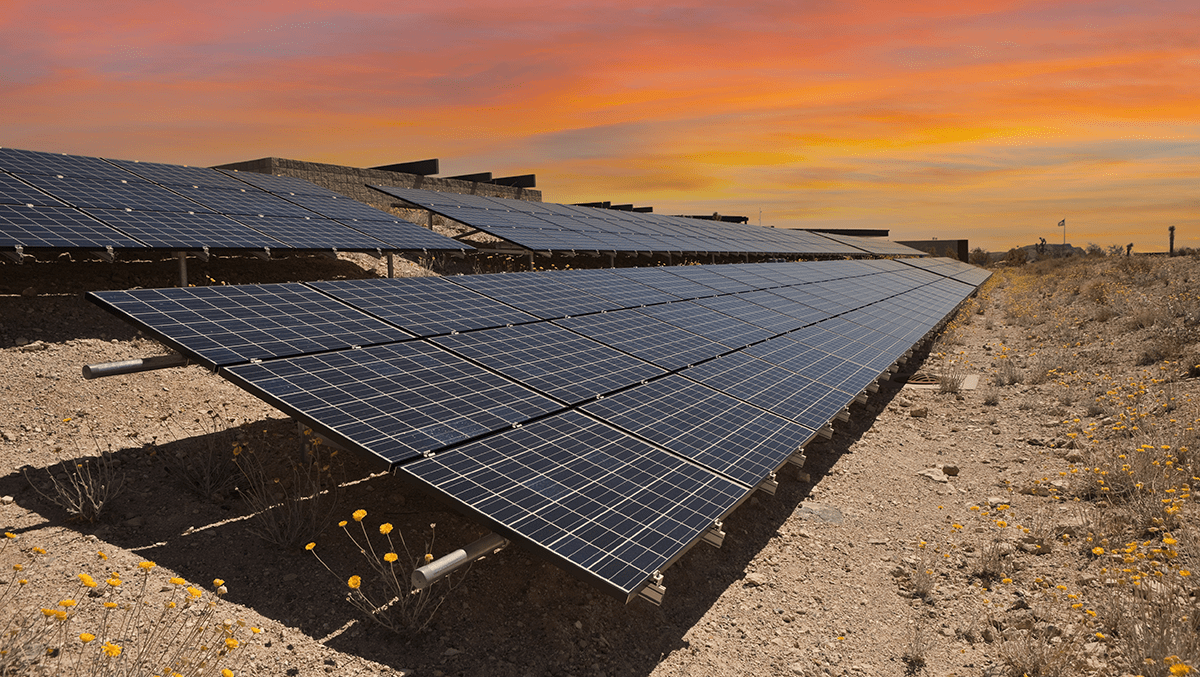

Climate change undeniably poses financial risks, with extreme weather events causing billions of dollars in losses annually. However, it also presents significant opportunities, particularly in the clean energy sector. Investors should have the freedom to capitalize on these opportunities without unnecessary restrictions.

Recognizing the financial implications of climate change, many investors have integrated climate considerations into their decision-making processes, following logical and data-driven approaches. Governments should not obstruct this essential risk management practice.

Unfortunately, some states have enacted laws that prohibit investors from factoring in climate impacts when making investment decisions, hindering their ability to fulfill their fiduciary duties. This interference undermines market efficiency and puts stakeholders at risk.

By embracing climate and sustainability risks, investors can make informed decisions that benefit both their portfolios and society as a whole. Respecting investor rights to assess and address these risks is imperative for a resilient and efficient market ecosystem.

A coalition of investors and leaders from various sectors is advocating for policies that safeguard the rights of investors to consider climate risks in their decision-making. By protecting this freedom, we can ensure a more resilient and responsible investment landscape for the benefit of all stakeholders.

It is crucial for all of us to come together and demand the freedom to invest responsibly, integrating climate and sustainability considerations into our financial decisions. Let’s stand up for investor rights and advocate for a more sustainable and prosperous future.

If you enjoyed this post, make sure to subscribe to Enterprising Investor for more insightful content.