With over 13 years of experience working in international equities and living abroad, I have gained valuable insights into the world of investing. Despite my background, I have chosen to focus predominantly on U.S. stocks in my portfolio. In this blog post, I shed light on why investing in international stocks might be overrated and advocate for a more U.S.-centric approach to investing.

If you’ve been feeling the fear of missing out on international stocks or wondering whether you should start investing in them, this post is for you. Here are some key reasons why I believe focusing on U.S. stocks is a sound investment strategy:

- Abundance of U.S. stocks and other risk assets for diversification.

- Comfort and familiarity in investing in what you know.

- Challenges in valuing international stocks due to governance and geopolitical risks.

- Limited availability of best-in-class companies with varying accounting standards outside the U.S.

- Difficulty in predicting which international stocks or countries will outperform.

Performance Of International Stocks Versus Domestic Stocks

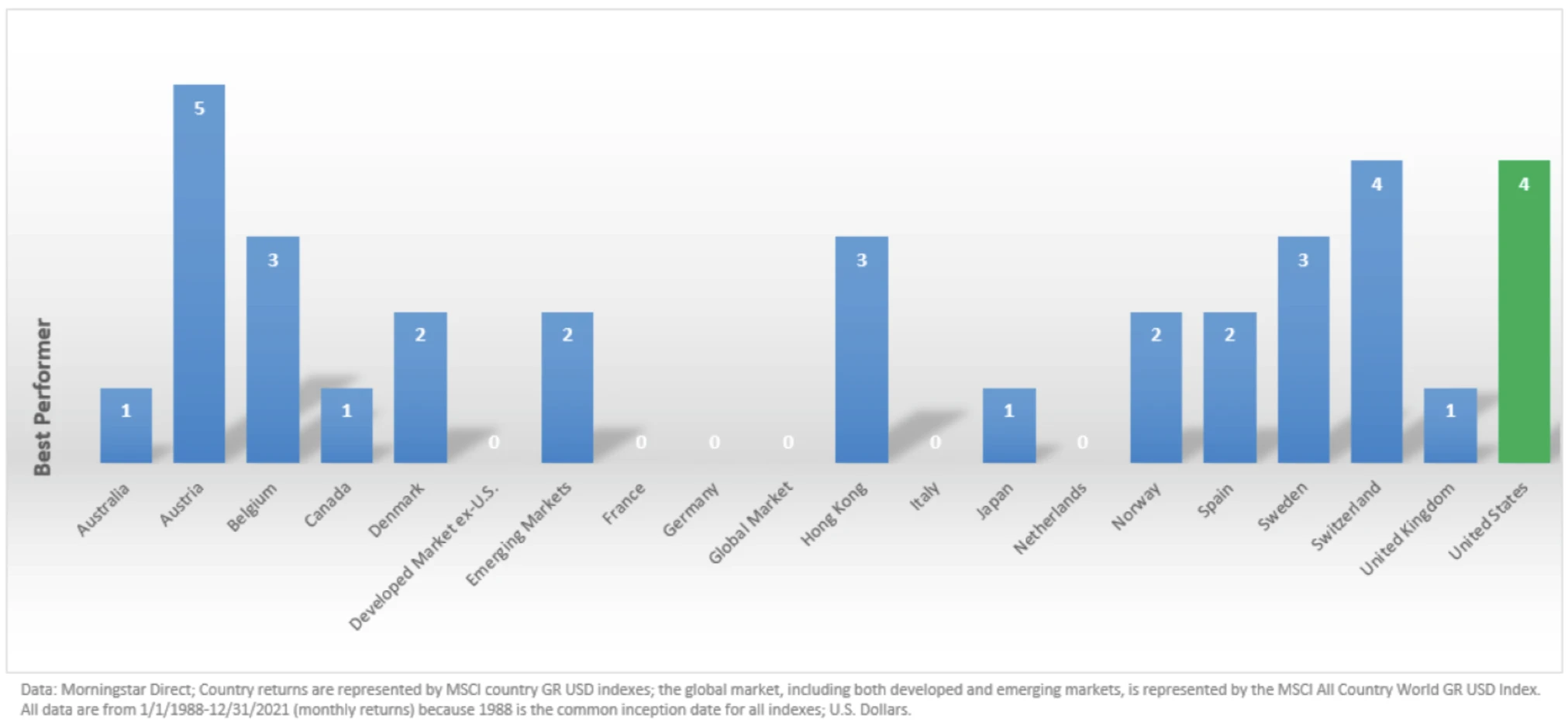

While international stocks may have their appeal, historical data suggests that investing solely in U.S. stocks has outperformed international counterparts in various periods. A graph from Morningstar depicting stock market returns since 1988 shows that the United States has been a top performer in several instances.

Furthermore, a chart compiled by the Hartford Funds indicates that while there have been periods when international stocks outperformed, the S&P 500 has proven to be a consistent performer over time.

Challenges in Consistently Identifying Outperforming International Stocks

Investing in international stocks presents challenges, including uncertainty in timing and duration of outperformance, as well as identifying which stocks or countries will excel. Predicting market trends and performance can be complex and risky, especially when dealing with geopolitical and currency risks.

International Stocks Offer Pure-Play Exposure

While international stocks may offer diversification, investing in U.S. multinational corporations with global exposure can provide similar benefits. Companies like Chevron, Pfizer, and Apple derive a significant portion of their revenue from overseas markets, allowing investors to tap into international growth opportunities without directly investing in international stocks.

The Main Risks Of Investing International Stocks

International stocks come with risks such as geopolitical instability, currency fluctuations, and lower market liquidity. Understanding these risks and the differences in corporate governance standards across countries is essential for investors considering international exposure.

Don’t Need To Invest In International Stocks

With a plethora of investment opportunities available in the U.S. market, investors may find little necessity to venture into international stocks. By focusing on high-quality U.S. assets and diversifying within the domestic market, investors can build a robust and resilient portfolio without the added complexity and risks of international investing.

Reader Questions And Suggestions

How much of your portfolio is in international stocks? Why do you invest in international stocks if there are already high-quality American stocks available? Share your thoughts and experiences with investing internationally.

For more insights on investing, financial strategies, and wealth-building, subscribe to our newsletter and join a community of over 60,000 individuals focusing on financial independence and success.