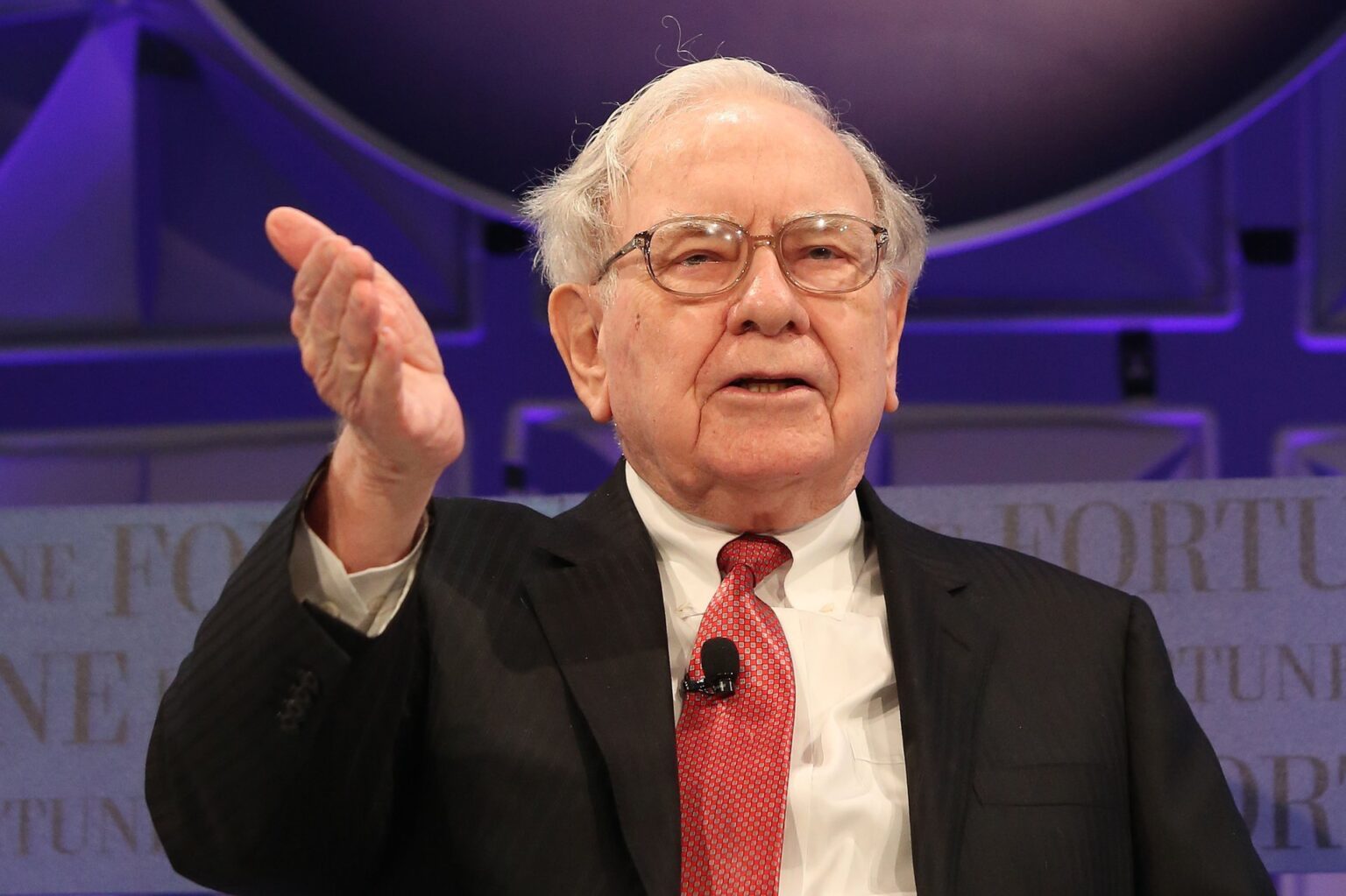

Warren Buffett, the legendary investor, chairman, and CEO of Berkshire Hathaway, has made headlines once again. Berkshire Hathaway now holds more in Treasury bills than even the Federal Reserve. As of the end of the second quarter of 2024, Berkshire held an impressive $234.6 billion in short-term investments in Treasury bills, surpassing the Federal Reserve’s holdings of $195.3 billion in Treasury bills, according to a CNBC report.

Buffett’s strategic investments and financial decisions have always captured the attention of investors and financial experts worldwide. Known for his long-term value investing approach and sharp business acumen, Buffett’s success in accumulating wealth and growing Berkshire Hathaway into a multinational conglomerate has been nothing short of monumental.

With Berkshire Hathaway’s increasing stake in Treasury bills, Buffett’s influence in the financial markets continues to be felt in significant ways. Investors and analysts eagerly await his next moves and insights as he navigates the ever-changing landscape of global finance.

As Buffett’s legacy continues to grow, so does his reputation as one of the most successful and respected investors of all time. His ability to generate consistent returns and build long-term wealth has cemented his status as a true icon in the world of finance. Stay tuned for more updates on Warren Buffett and Berkshire Hathaway’s latest developments.