Overview

With the increasing demand for clean technologies, the need for advanced rechargeable batteries to power the green economy is also on the rise. However, the heavy reliance of the United States and the European Union on countries like Japan, South Korea, and China for 80% of the world’s battery production poses a risk to their auto industries. China, being a major processor and producer of battery materials, holds substantial influence over pricing and supply chain dynamics.

To reduce this dependency and restructure supply chains, both the United States and the European Union have turned to Canada as a secure and stable source of sustainable raw materials, particularly lithium crucial for the expanding electric vehicle market. This shift makes mining companies with projects in Canada supplying materials for high-tech rechargeable batteries, such as lithium, an attractive investment opportunity.

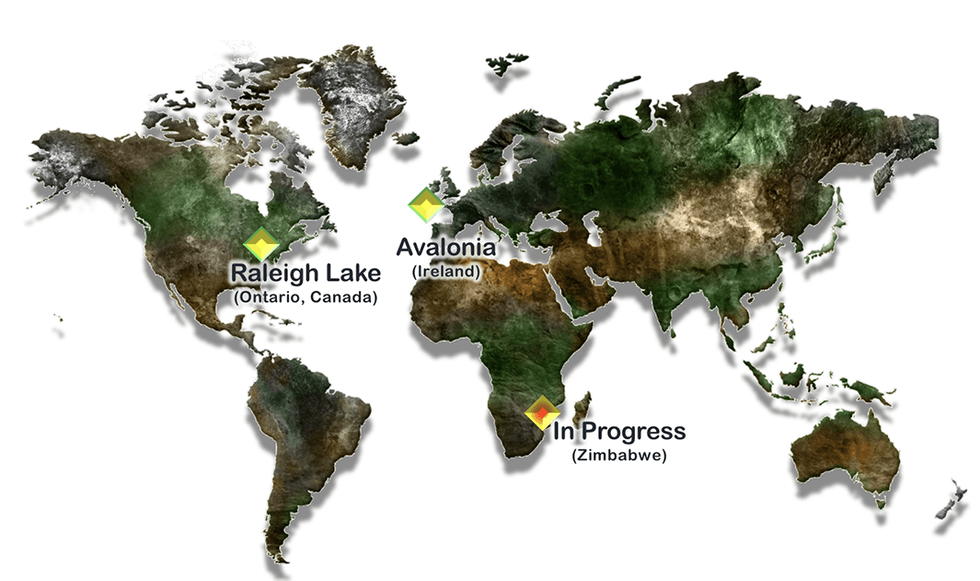

International Lithium (TSXV: ILC, OTC: ILHMF, FRA: IAH, OTCQB: ILHMF) is a mineral exploration company specializing in developing a portfolio of lithium and rare metals projects and royalties in Canada and Ireland. The company is helmed by a seasoned management team with a successful track record of advancing promising projects in established mining regions with low technical risks.

International Lithium creates shareholder value through project development, strategic partnerships, and project sales. The company’s key projects include the Raleigh Lake and Avalonia projects.

The flagship Raleigh Lake project is a wholly owned and highly prospective lithium, rubidium, and caesium project in Ontario. Spanning 48,500 hectares adjacent to key infrastructure, the project has shown promising drill results, with recent prospects uncovering new pegmatites at surface level.

A positive preliminary economic assessment for the Raleigh Lake project reveals strong financial performance and potential in the lithium market. Additionally, International Lithium’s joint venture lithium project, Avalonia, in Ireland has returned promising drill results and is currently under an option agreement.

International Lithium is bolstered by a strong financial position, with recent successful share sales and divestments, positioning the company for further growth and development in the lithium and critical minerals sector.

The company continues to focus on advancing its flagship Raleigh project while actively seeking new properties to expand its mineral portfolio. A recent acquisition of the Firesteel project signals International Lithium’s commitment to diversifying its critical minerals portfolio and exploring new opportunities in the market.