Understanding the Financial Aspects of Homeownership

Fluctuating home values can have a significant impact on your financial situation. This is especially true if market trends lead to a decrease in home values over time, adding to the financial burden on homeowners.

When it comes to owning a home, moving within a short period can result in fees that outweigh any equity gains you may have. It’s similar to driving a new car off the lot – instant depreciation. Similarly, your home’s value can decrease over time, and it takes time to offset these costs.

Most people tend to stay in their homes for less than 8 years. Before the 2008 financial crisis, the average tenure was around 4 years, but now it’s longer. It’s essential not to succumb to peer pressure to buy a house if you know you’ll be moving within a few years. Renting and investing in S&P index funds might be a more profitable option in such cases.

Common Mistake: Thinking that buying a house when planning to move soon is a better financial decision than renting.

Reality: Buying for a short term typically results in financial losses once all costs are considered.

Is Your Monthly Housing Cost within 28% of Your Gross Income?

Your total housing costs, including mortgage payments, should not exceed 28% of your gross income. Going beyond this percentage can lead to financial strain in case of unexpected expenses or changes in income. Utilize the 28/36 Rule to determine if your housing costs are manageable.

For instance, if you earn $10,000 per month and your housing costs are $2,000, accounting for 20% of your gross income, you are within the recommended range. It’s crucial to factor in all housing costs, including taxes, interest, maintenance, and other expenses, to ensure financial stability.

Assessing the affordability of monthly payments plays a vital role in overall financial planning for homeownership, allowing you to maintain your lifestyle while pursuing other financial goals.

Exceptions to the 28/36 Rule

- Housing costs exceeding 28% in high-cost living areas or with no debt.

- Potential income growth or impending job promotions can slightly extend the recommended percentage.

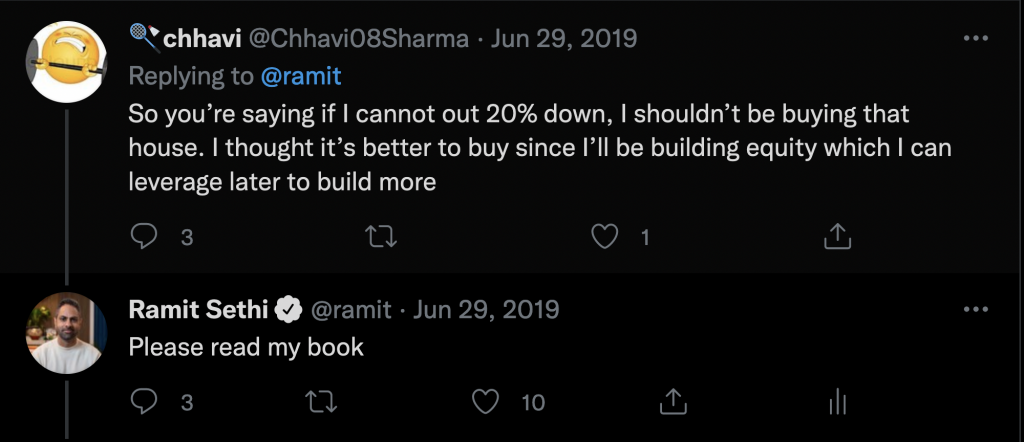

Have You Saved a 20% Down Payment?

Saving 20% down payment before purchasing a house is crucial for financial stability. Beyond avoiding Private Mortgage Insurance (PMI), this practice instills a savings habit necessary for handling unexpected housing expenses. It’s essential to consult multiple mortgage lenders to secure favorable terms that align with your financial goals.

Acknowledging Market Fluctuations

Real estate investments are subject to market fluctuations, and the expectation of perpetual value increase may not always hold. While owning a house can offer various benefits, such as stability for your family or personal fulfillment, financial considerations should be rationalized.

Valid Reasons to Purchase a House

- Rooted family or community ties.

- Proximity to elderly relatives for caregiving.

- Customization and personalization opportunities.

- Enjoyment of home improvement projects.

- Personal preference for homeownership.

Ensure that your decision to buy a house aligns with your genuine motives and not solely based on inflated property values. Buying when you are financially and emotionally ready secures a fulfilling homeownership experience.

Assessing the Purchase Excitement

If the idea of buying a house feels like a burden or obligation, reassess your readiness. Renting can be a practical choice, and there’s no shame in preferring it. Renting can offer flexibility and financial advantages, as discussed in this video.